Real estate in germany for 1€ with security tokens

Real Estate Security Tokens will revolutionize the German Real Estate industry by making investing in German properties easier, cheaper, and more liquid than ever.

Introduction

Real Estate in Germany has been a great investment over the last decades and will most likely continue to be a great investment in the foreseeable future. The challenge for many internationals living in Germany is that the traditional way of investing in Real Estate has a number of requirements that mainly come from the financing bank.

Because of the surging property prices in the last years, many people do not have the required equity to buy Real Estate on their own. Expats living the expat lifestyle also do not want the long commitment that Real Estate requires (e.g. 10-year holding period until you can sell a property tax-free). Many banks in Germany also do not finance if a person does not have a permanent residency or sufficient German skills.

Tokenization is solving all the challenges of traditional Real Estate investing by allowing investors to buy properties cheaper, easier, and more liquid than ever before. With Real Estate Security Tokens we will revolutionize the traditional & old-school German Real Estate investing industry. Here is how tokenization works in detail:

How real estate tokenization works

Imagine any property in Germany that is very interesting from an investment perspective. Not a single flat inside a property – a complete property that is worth millions of Euros. The first problem is that many people cannot afford a property worth that much money. So the first idea is that many investors buy that property together and split it so they all own a share of the property they wanted to buy in the first place.

The problem is that the German land registry is not allowing multiple people as owners of the property (at least not as many people as required to buy a property with millions of Euros). And even if the German land registry would allow hundreds of investors, the land registry would need to be changed every time an investor wanted to cash out (which would mean high notary fees every time).

In order to solve the equity issue and the liquidity issue at the same time, one single person or company would need to be the owner of the property. E.g. a special purpose entity that has only one purpose: Purchasing the property the investors want and holding it. Thanks to the special purpose entity the land registry problems are solved.

Historically, that special purpose entity would need to go public on a stock exchange so that investors have the chance to buy a share of it. As Initial Public Offerings take years and cost millions of Euros, it is hardly worth it to split a special-purpose entity holding only one single property.

Instead of going public, the special purpose entity can also issue security tokens that represent a share of that special purpose entity, and therefore a share of the property the investors wanted to buy. E.g. 1 million security tokens for a property worth 1 million Euros (=tokenization).

As security tokens represent a legal claim against that special purpose entity just like a regular stock or a bond does, investors own a share of the property, a share of the rental income, as well as a share of the resale value with their security tokens.

Every investor owning security tokens in that special purpose entity could also vote on what is in the best interest of all security token investors. If +50% of all security token holders vote to sell the property, the resale value of the property would be split equally among all 1 million security tokens.

Tokenization combines the advantages of raising money in the private capital markets (e.g. banks) with the increased liquidity offered by public capital markets (stock exchanges). Because security tokens can be traded on a blockchain like Ethereum, Stellar, or Polygon around the clock 24/7 at virtually no cost.

Important: Blockchain does not automatically mean cryptocurrency, NFT, or another coin with no real value behind it. Security tokens represent at all times a legal claim against the underlying special purpose entity. So investors enjoy full legal safety as well as their share of the rental income and resale value in case the property gets sold.

Investing in Real Estate as a Private Person vs a Company

As the German land registry is not digitalized yet and does not allow tokenizing assets directly, the special purpose entity needs to be created as the 100% owner of the property. That is absolutely no harm, as investing in Real Estate as a company is all-around the board better than investing in Real Estate as a private person.

Differences of investing in properties as a private person vs. investing in properties as a company (SPV):

- Higher purchasing power: When investors join forces under the security token structure they can purchase more property than each investor could purchase individually.

- More planable: As the special purpose entity owns the property 100%, there is no owners association (WEG in German) with maybe conflicting interests that investors have to deal with.

- No ground purchasing taxes: Companies can buy properties in a share deal instead of an asset deal that saves anything from 3,5% to 6,5% ground purchasing taxes (depending on the German state).

- Fewer taxes on rental income: Rental income for private investors is taxed like income from work with up to 45%. Our special purpose entity can be exempt from trade tax and pay 15% in taxes only.

- Tax-free sale: Private investors can sell rental properties completely free of tax after holding them for 10 years. Companies can sell properties tax-free after just 6 years (under certain conditions).

- Resale target group: Private investors can sell small properties to other private investors. The special purpose entity can sell to institutional investors, pension funds, family offices, etc which relates to a higher resale value.

- Depreciation: Private investors can write off 2% of the investment property value from their taxes every single year. Companies investing in Real Estate can write off 3% per year – 50% more than the private investor.

Real Estate Security Tokens vs Other Forms of Investing in Real Estate

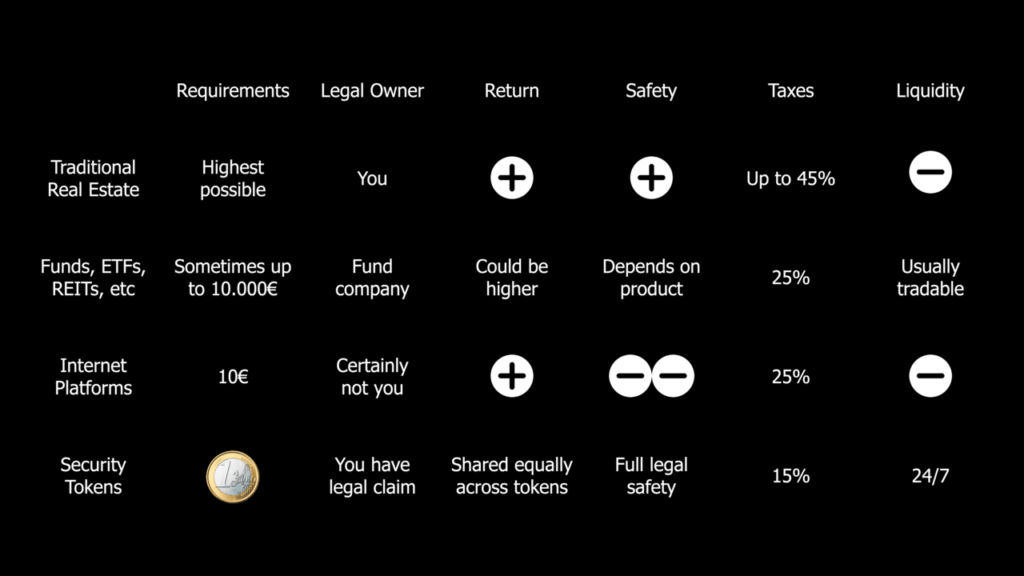

As there are many different forms of investing in properties, Real Estate security tokens might not seem as revolutionary as they actually are. The table below compares all possibilities of investing in Real Estate in different categories. Security tokens are making property investments easier, more affordable, and more liquid than any other existing alternative.

The traditional way of buying properties has the highest requirements especially from the legal side (with the notary, etc) and from the financing bank (right visa status, employment without probation period, understanding decent German, etc). With these requirements comes full legal safety which is a huge plus of the traditional investing way. The downside is clearly the high taxation of a private Real Estate investor.

Real Estate ETFs, Real Estate funds, or Real Estate Investment Trusts (REITs) have much fewer requirements than the traditional way of investing in properties. The downside is that all these investment vehicles are the real owner of the property and therefore the investment companies do not share the entire profit with investors. That is also why safety can be severely lacking for investors in certain investment products of this category.

These upcoming internet platforms like Peer-to-Peer investing platforms offered up to now the easiest way of Real Estate investing with possibly the highest return. The high return comes from the severe lack of safety, as most internet platforms offer almost no security for their investors when it comes to ranks of the loans. Peer-to-Peer investors are in most cases the last to see money in case the investment does not work out as planned.

With Real Estate security tokens the requirements are as low as it gets with just 1 Euro minimum investment. This 1€ will make you the legal owner of the property as you have a legal claim against the special purpose entity that holds the property for the investors. That is also why profits are shared equally among all security token holders.

Because of your legal claim against the special purpose entity legal safety for investors is as high as it gets. All while tax rates are the lowest possible in Germany with just 15% on rental income, and possibly a tax-free sale of the property after just 6 years. In case any investor wants to cash out, security tokens can be bought and sold on the blockchain 24/7.

Are you interested to invest in German real estate for just 1€? Check out real estate security tokens from GermanReal.Estate.

Conclusion

Go live of the Real Estate security tokens marketplace GermanReal.Estate is expected to be in June or July 2022. Interested investors can visit the website already and sign up for regular updates by email or by following the social media channels of GermanReal.Estate.

Thanks to security tokens there is no need for a German residency, high commitment, or knowledge of the German property market required when investing in Real Estate in Germany. Sign up for free on GermanReal.Estate and earn passive rental income right after completing the verification process.

Over time, the combination of community tokens, as well as property development tokens with external, professional property developers, will make GermanReal.Estate the stock exchange for security tokens. Join the future of investing in German Real Estate and let us bring the Real Estate investing industry in Germany to a completely new level.

Pingback: 5 To Do’s Against High Inflation – PerFinEx

Pingback: Real Estate Market in Germany - Future Developments

Pingback: Taxes on Investments - How to Invest in Germany

Pingback: Passive Income In Germany

Pingback: Investing in Real Estate - 5 Affordable Ways

Pingback: GermanReal.Estate Security Token - Voting

Pingback: Magic Triangle of Investing - How to Invest in Germany

Pingback: Investment Schemes in Germany

Pingback: Real Estate Security Tokens

Pingback: The Real Estate security Token: Welcome Home MG - GermanReal.Estate

Pingback: How to invest 25.000€?

Pingback: Real Estate & Passive Income: Which Property Should You Invest In? | GermanReal.Estate

Pingback: Real Estate & Passive Income: Which Property Should You Invest In?

Pingback: Immobilien & Passives Einkommen: In Welche Immobilie Sollten Sie Investieren?

Pingback: How To Save For Real Estate